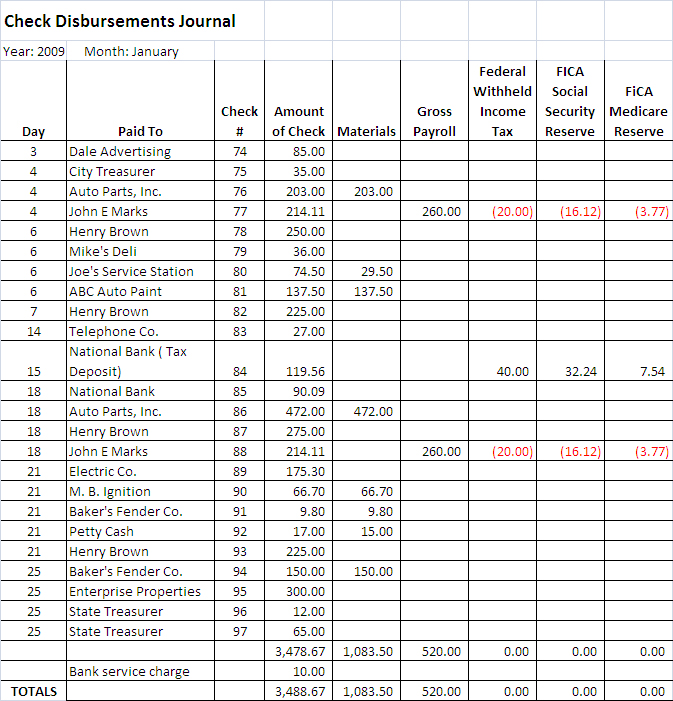

3. Check Disbursements Journal

Henry enters checks drawn on the business checking account in the Check Disbursements Journal each day. All checks are pre-numbered and each check number is listed and accounted for in the column provided in the journal. Frequent expenses have their own headings across the sheet. He enters In a separate column expenses that require comparatively numerous or large payments each month, such as materials, gross payroll, and rent. Under the General Accounts column, he enters small expenses that normally have only one or two monthly payments, such as licenses and postage.

Henry does not pay personal or non-business expenses by checks drawn on the business account. If he did, he would record them in the journal, even though he could not deduct them as a business expense. Henry carries the January total of expenses for materials ($1,083.50) to the Annual Summary. Similarly, he enters the monthly total of expenses for telephone, truck/Auto, etc., in the appropriate columns of that summary.