There are computer packages you can use for recordkeeping that can be purchased in many retail stores or on the Internet. The great thing about a computerized software like Quickbooks is that you enter things like you would in a single-entry bookkeeping system and it will convert it automatically into a double-entry booking system, so that you can run very sophisticated reports. While most software programs require very little knowledge of bookkeeping and accounting, you should probably spend a few dollars and have an expert set it up for your type of business. Or at least take some classes before you plunge in. It may save you a lot of headaches later if you have to fix things.

If you use a computerized system, you must able to produce sufficient legible records to support and verify entries made on your return and determine your correct tax liability. To meet this qualification, the machine-sensible records must reconcile with your books and return. These records must provide enough detail to identify the underlying source documents.

You must also keep all machine-sensible records and a complete description of the computerized portion of your recordkeeping system. This documentation must be sufficiently detailed to show all of the following items.

- Functions being performed as the data flows through the system

- Controls used to ensure accurate and reliable processing

- Controls used to prevent the unauthorized addition, alteration, or deletion of retained records

- Charts of accounts and detailed account descriptions

In simpler terms, remember to backup your software and databases!

Storage Systems

Microfilm and microfiche reproductions of general books of account, such as cash books, journals, voucher registers, and ledgers, are accepted for recordkeeping purposes if they comply with Revenue Procedure 97-22. Records maintained in an electronic storage system are accepted for recordkeeping purposes if they comply with Procedure 97-22. An electronic storage system is one that either images hardcopy (paper) books and records or transfers computerized books and records are scanned or copied to an electronic storage media, such as optical disk, CD-R or DVD-R. Put simply, you can scan or copy all of your records into your computer, burn them onto a DVD-R, throw the DVD in a safe deposit box for safety, and shred all that paper. If you ever need paper copies again, you can simply print out copies of the originals.

How Long to Keep Records

You must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. This means you must keep records that support an item of income or deduction on a return until the period of limitations for that return run out.

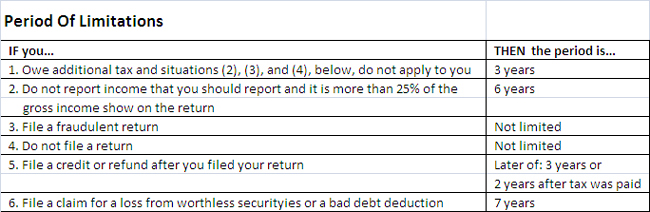

The period of limitations is the period of time in which you can amend your return to claim a credit or refund, or the IRS can assess additional tax. The table below contains the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.