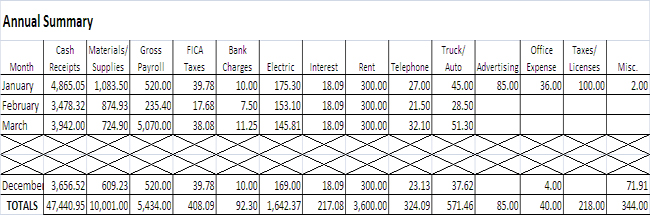

5. Annual Summary

This annual summary of monthly cash receipts and expense totals provides the final amounts to enter on Henry's tax return. He figures the cash receipts total from the total of monthly cash receipts shown in the Monthly Summary of Cash Receipts. He figures the expense totals from the totals of monthly expense items shown in the Check Disbursements Journal. As in the journal, he keeps each major expense in a separate column.

Henry carries the cash receipts total shown in the annual summary ($47,440.95) to Part I of Schedule C (not illustrated). He carries the total for materials ($10,001.00) to Part II of Schedule C. A business that keeps materials and supplies on hand generally must complete the inventory lines in Part III of Schedule C. However, there are no inventories of materials and supplies in this example. Henry buys parts and supplies on a per-job basis; he does not keep them on hand.

Henry enters annual totals for interest, rent taxes, and wages on the appropriate lines in Part II of Schedule C. The total for taxes and licenses includes the employer's share of social security and Medicare taxes, and the business license fee. He enters the total of other annual business expenses on the 'Other expenses' line of Schedule C.